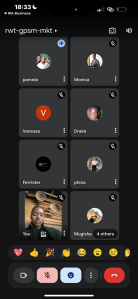

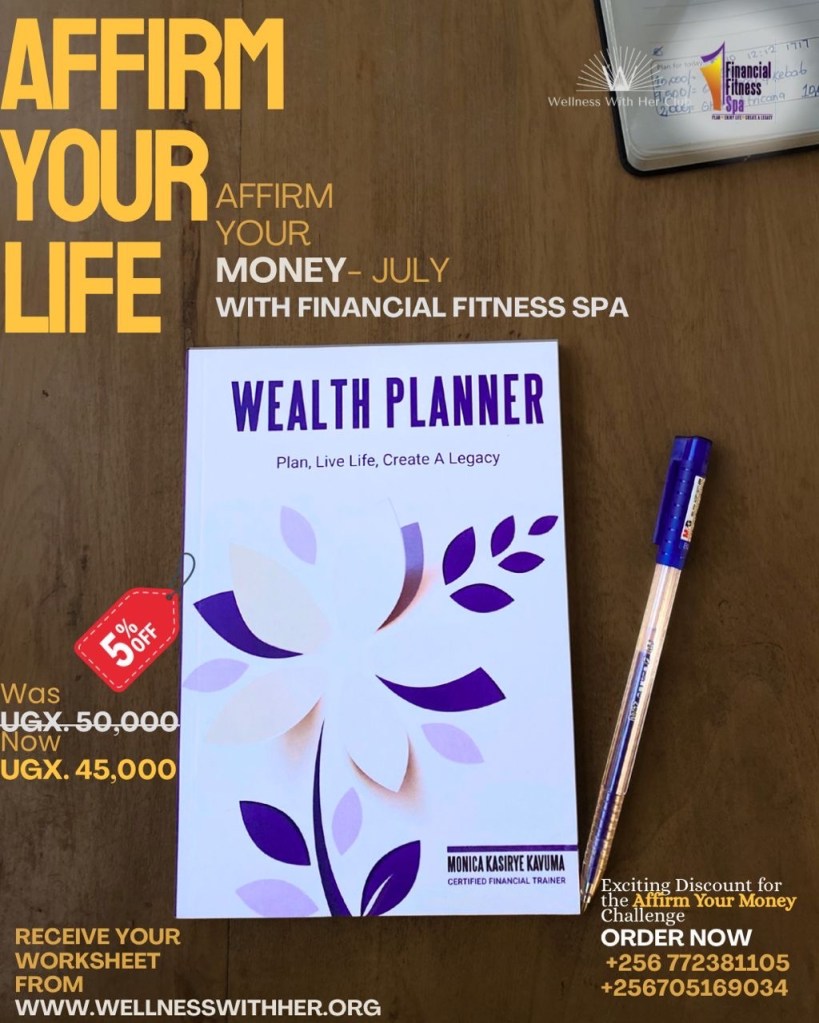

Last Monday, we had the pleasure of hosting an insightful and down-to-earth Google Meet session with the powerhouse duo from Financial Fitness Spa; Monica Kasirye-Kasanvu and Pamela Ssaka. It was more than just a financial literacy talk, it was a real girl-to-girl (okay, there were some gentlemen as well) conversation about money, independence, and how taxes fit into our everyday lives.

This deep dive helped demystify the world of taxes for us. We discovered that many Ugandans actually qualify for certain tax exemptions and benefits; but only if they’re aware. Knowledge is power, and awareness is financial protection.

One of the major updates shared was that the Tax Identification Number (TIN) is being phased out. In its place, your National Identification Number (NIN) will take centre stage; just like the social security number in the U.S. This NIN will be used across your financial life: whether you’re spending, receiving money, registering for services, or seeking education or healthcare.

But with this new system, comes responsibility. Pamela strongly urged us to be cautious about where and with whom we share our NIN. Every exchange is a potential transaction. Guard it wisely.

Another key learning was around income thresholds. If you earn above UGX 2,820,000 annually, you’re liable to be taxed. If you earn below UGX 235,000 monthly, you’re currently exempt. Still, there are various tax categories to be aware of:

● PAYE (Pay As You Earn)

● Income Tax

● Withholding Tax (common with consultants)

● Value-Added Tax (VAT)

● Customs and import duties

And here’s the part that hit home: when negotiating your pay, especially if you’re self-employed, consulting, or receiving gigs, taxes matter. If you want to go home with UGX 2 million, you may need to ask for UGX 2.5 million.

Pricing confidently means protecting your income. As Monica and Pamela put it: “Awareness protects you from being undercut.”

There was also some good news shared; Christmas came early via new tax exemptions, effective 1st July:●

● If you’re a registered business with your start up capital less than UGX 500 million annually, and you file your returns on time, you’ll not pay income tax for three years (valid only for businesses registered after July 1st).

• SACCOs and their members are currently exempt from tax until June 2027. So, now might be a good time to join or invest in one.

We also explored Uganda Revenue Authority’s self-assessment system, where you can pay taxes through a unique Payment Registration Number generated on the URA portal. For business owners and importers, holding on to receipts and maintaining solid records is vital for smooth declarations.

One more gem? Always consider hiring a tax advisor. Their services are an investment, one that could save you from costly mistakes down the road.

A heartfelt thank you to the Financial Fitness Spa team for their time, clarity, and genuine commitment to empowering women through financial knowledge. For those who want to book a personal session or find out more, click here to access their services.

Let’s keep the conversation going.

Join us on Monday 28th August for a conversation on Investment

Let’s keep learning, growing, and owning our financial power, together.

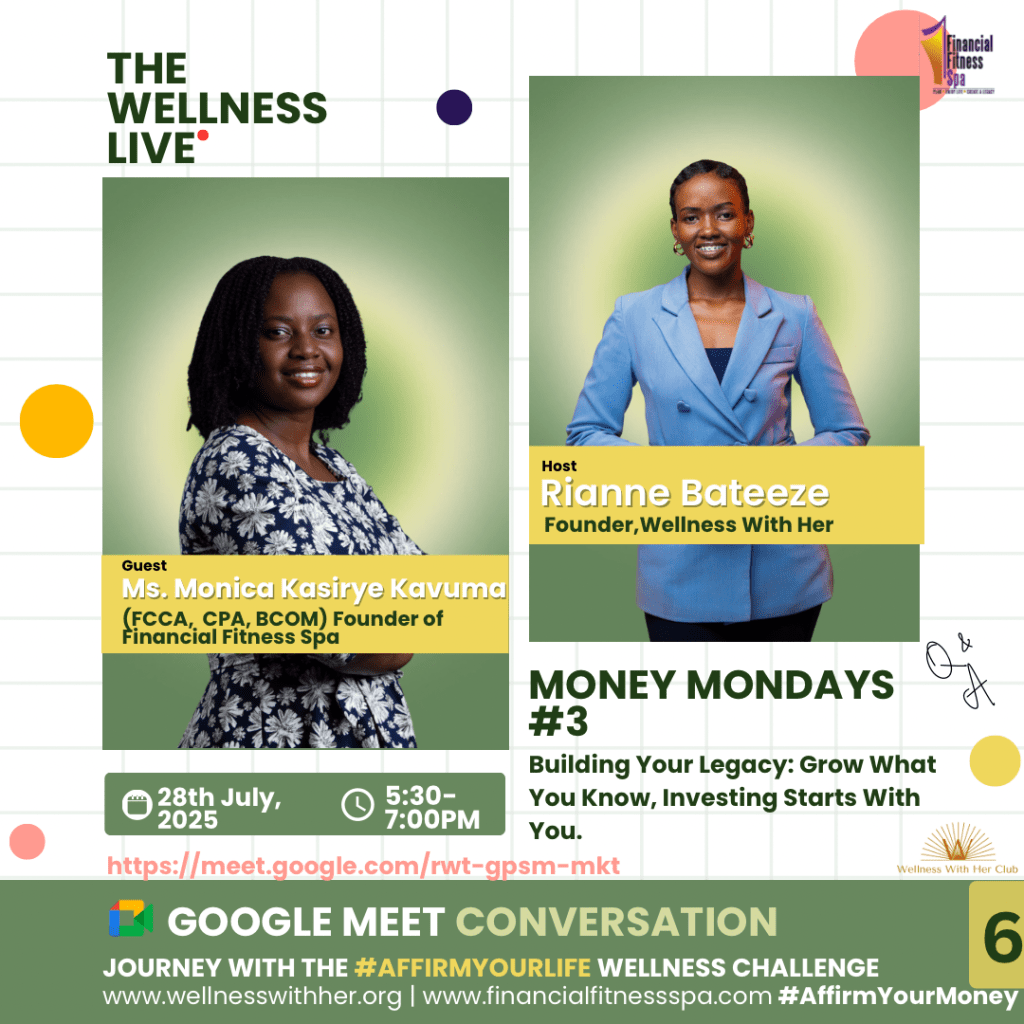

MORE RESOURCES FROM FINANCIAL FITNESS SPA

Date: 31st July 2025

Time: 3pm -4pm

Register Now

It’s not too late to receive your worksheet for the financial month

Leave a comment